lately

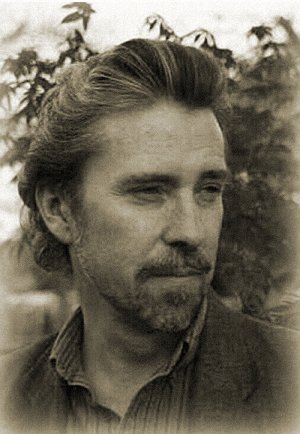

ralph robert moore

BUY MY BOOKS | HOME | FICTION | ESSAYS | ON-LINE DIARY | MARGINALIA | GALLERY | INTERACTIVE FEATURES | FAQ | SEARCH ENGINE | LINKS | CONTACT

www.ralphrobertmoore.com

the official website for the writings of

ralph robert moore

Copyright © 2005 by Ralph Robert Moore.

Print in HTML format.

Return to lately 2005.

cow appreciation day

Back in the mid-nineties, the company I worked for moved to a new building.

In fact, for the first time, the company would own, rather than rent, the building in which it had its offices.

The building was built specifically for us, in far north Dallas, where property values were cheap, the land mostly fields, weeds, crickets.

It was a two-story building. It looked institutional, like a small hospital, but hey. It was ours. We were excited.

Once the structure was up, the interior finished for the most part, black cables still hanging down from the slid-aside ceiling tiles, a group of us made the trip to see what our new working conditions would be like.

Nearly all the several hundred employees in the company were going to be put into cubicles, albeit taller cubicles than they had before, but the group I was with would have private offices. There was Bill, who handled finances for the company, Gerald, who was in charge of accounting, Andrea, who oversaw marketing, Stevie, in charge of operations, and me, who headed the legal department. After my office was the president's office, but he hadn't joined our group that day.

The private offices were located on the second floor, running along the wall facing the front parking lot.

We went around the bend in the upper hallway together, stepping around boxes.

Gerald's office was up first.

Outside each office, in the wall beside the brass-knobbed door, was a floor to ceiling panel of glass, so you could look inside.

Cool.

But even cooler, in that tall, narrow panel of glass was etched the name of the occupant.

So in the glass panel beside Gerald's office, for example, the etching said, Gerald B___. (I'm not using last names).

This meant a lot to us.

It suggested there was some permanence to our jobs, in these uncertain times. Or else why would the company go to the expense of etching our names in glass, rather than just screwing up a nameplate that could be easily slid out?

I remember we all stopped in the carpeted hallway, as a group, to admire the etching of Gerald's name in the glass, and breathe a sigh of relief.

Gerald entered his office, looking at the glass etching from behind.

Tilting his head, he reached forward, touched the etching's backside.

With a voice like the character in the Twilight Zone episode, To Serve Mankind, who says, "It's a cookbook!", he turned to us and said, "It's a decal!"

We weren't certain what he meant, at first.

But sure enough, crowding into his office, looking at the back of the glass etching, we realized it wasn't a beveled etching at all.

It was a flat plastic decal drawn to look like a permanent glass etching, stuck to the window.

Gerald slipped his thumbnail under one corner of the decal. "I could actually peel it off!"

"Probably a bad idea," I said.

But six months later, after Gerald had been let go, someone from building maintenance peeled the decal off, long sticky clear plastic strip floating like a nuisance off the tip of his thumb.

I forget who occupied the office after Gerald, but the company didn't bother putting up a fake etched-in-glass decal with his successor's name. Even that minimal expense, about the cost of a box of paperclips, was too much.

Just as well, since the successor was gone in a couple of months, too.

In fact, after the end of that first year of excitement of moving into new quarters, I was the only one out of that group that day still working for the company.

That's the thing about business. Your name is peelable.

As I said last month, I lost my job after working for the same company (through a succession of acquisitions and consolidations) for fifteen years (I had actually been let go back in 2000, but after a few weeks the company asked me to come back, once they realized they didn't really have a replacement for me.)

Since 2000, I had worked from home, nice in its own right, in that you can get a lot more work done, without having to stop to look at someone's vacation pictures, and a godsend when Mary had her stroke in 2002, and needed to have someone home to take care of her.

Because I worked from home, I had all the company's files relevant to my job in five filing cabinets I kept in the garage.

I had to box these files now, to ship them up to Ohio for my successor to use.

There's something melancholy about going through large numbers of files, preparing them for shipment.

Some of the files I hadn't looked at in years. I pulled them out now, to see if they were ready for shipping, and the rubber bands bundling the pages were so old they had corroded, broken apart into short lengths that stuck like dried spaghetti noodles to the outside pages of the bundles.

Some sheets were decorated with blue-inked whorls from years ago, where I was obviously testing a pen to see if it could still write. And you can always recognize, oh, those whorls are mine. I wonder what I was going to write, on another sheet of paper, at that point? At that pen test? Something to do with work? The start of a food list? A note about a short story I was writing?

During my last days with the company, whenever I had to write a note on a file, I made a conscientious effort to use neat handwriting, since someone other than me, for the first time in fifteen years, would, in the future, be referring to the note.

Since Mary and I would be without my income, at least until I found another job, we decided to come up with ways in which we could economize.

Part of being able to sustain yourself financially is not just the amount of money you bring in each month, but the amount of money you pay out. The less you have to spend each month, the less you need to earn. This may seem like an obvious point, but I think it's overlooked by a lot of people.

Right now, we owe a little over seventy thousand dollars on our mortgage. We thought about simply paying the balance off from our savings, which would reduce our monthly expenses by about eight hundred dollars (we'd still have to pay property taxes and homeowner's insurance), but that seemed like a lot of money to say goodbye to for a fairly modest reduction. Plus, what if I found a new job in a month or two?

The rest of our monthly bills are more or less fixed, like they are for everyone. Electricity, water, gas, phone, satellite TV, broadband access. Our car is paid off, and we've always paid our credit card balances in full.

So the one area where we could possibly reduce our monthly expenses was food.

We had been spending about twelve to fifteen hundred dollars a month on food.

So as an exercise, and perhaps also to have the knowledge that I no longer had a job sink in, we did a price comparison among supermarkets.

We were careful detectives, going into each supermarket, writing down the cost of the products we most often bought. Mayonnaise, paper towels, cat food, two dozen other items.

We chose three supermarkets for our survey: Minyards, where we had never shopped, known as a discount store, with narrow aisles and a shabby feel; Kroger's, which had a greater variety of foods, friendly clerks, but not the cleanest and brightest of all stores; and Super Target, which was bright and clean, with wide aisles, a large variety of products.

Going into our research, we expected Minyards to have the lowest prices, Kroger's to be somewhere in the middle, and Super Target to be the most expensive.

The truth was exactly the reverse of what we expected.

Kroger's and Super Target had just about the same prices for most items. Super Target was consistently lower, usually by only a few cents, although with some products, like a case of wet cat food, significantly lower (by about five dollars). Minyards, on the other hand, despite its ad campaigns as a discount store, was the most expensive. We were shocked. Every item we compared was significantly more expensive at Minyards, by at least one dollar, and in many cases by several dollars. Add up all those products, and you could be spending fifty or more dollars at week at Minyards than at Super Target, and going through a far less pleasant shopping experience.

Once my job ended, there was a lot I had to take care of.

I applied for unemployment insurance, which you can now do on-line. I also had to sign up with the Texas Workforce, something else you can do over the Internet, meant to increase your chances of finding a new job (a sign-up is required to receive unemployment benefits), but signing-up, I realized how primitive the system is. You have to choose, from a drop-down menu, what category of job you had before. None of the selections matched what I did. Most of them focused on food-handling, forestry, farm work.

Another issue was health insurance.

My only insurance, as is the case with most Americans, was through my employer. I lost all that once I lost my job. Mary has medical insurance through Medicare, because of her disability resulting from her stroke, but no drug coverage. That's a big deal. She takes a number of drugs each month. The week after my job ended, I took her to an ophthalmologist about a sty on her lower left eyelid. The visit was mostly covered by Medicare (we still had to pay forty-something dollars). The doctor prescribed an antibiotic ointment to clear up the sty. I thought, naively, it would cost ten to fifteen dollars, since it wasn't a high end drug like a statin (cholesterol-lowering drug) or blood pressure reducer. In fact, it cost seventy-five dollars, for a tiny little tube (picture in your mind how tiny a tiny little tube is, and I guarantee you this tube was tinier than that).

Mary takes four different drugs each day, so it was important I find new drug coverage for her.

The first thing I did was call Kroger Pharmacy, where we have Mary's prescriptions filled, to find out how much the drugs cost if you have no insurance (the "cash price", as it's called). I needed these figures to see how much we would save by signing up for a specific drug insurance. Obviously, the amount we saved would have to more than offset the cost of the insurance, for the insurance to be worth purchasing.

Here are the cash prices for Mary's drugs, for a thirty-day supply:

Coumadin (6mg) $38.09

Protonix (40mg) $109.09

Altace (2.5mg) $50.69

Lipitor (10mg) $76.29

In other words, $274.16 a month.

I went on Google, put in the search term, "prescription drug coverage".

Most of the coverage cost twenty to thirty dollars a month.

So far, so good.

If one of the coverages would reduce our actual purchase costs by, let's say, one hundred dollars, the coverage would be worth it.

So I started poking around the sites, looking for the actual savings we would realize on specific drugs.

That was often hard to find, and when I did find it, the information was discouraging.

Most of the sites said they offered "Up to 90% savings", but of course, whenever you see a statement with the qualifier, "Up to," the statement is worthless. There are thousands of drugs sold in the United States. If the insurance offers a 90% savings on one of those drugs, and a 2% savings on all the other thousands, the statement, "Up to 90% savings" is legally true.

But false according to every other standard.

Many of the sites didn't list their savings on specific drugs, or only listed savings on a few drugs, none of which Mary used. We'd be signing up for the insurance blind, not knowing if it would save us money or not.

I did find one site with a fairly comprehensive list of savings, but the savings were literally only a dollar or two, not justifying the thirty dollar a month cost of the insurance.

Another site listed drug savings according to a four-tier system. After the coverage's discount was applied, drugs in the third tier (in which most of Mary's drugs fell) would end up costing us "up to" $50.

There was an 800 number, so I called it. Got one of their Sales Representatives on the phone.

"I'm thinking of signing my wife up for your prescription drug coverage, but wanted a little more information about benefits. For example, one drug she takes, Coumadin, is listed in the third tier. Your site says our cost after your discount would be up to fifty dollars. What would the actual cost be for a 30-day supply of Coumadin at a 6mg dose?"

She cleared her throat. "It would be fifty dollars."

"Fifty dollars exactly?"

"Yes, sir."

"You answered so quickly. Does that mean our out-of-pocket cost for any drug in the third tier would be fifty dollars?"

"Yes, sir."

"If that's the case, why does it say, "up to"? Why doesn't it just say, "fifty dollars"?"

"Well, it would be less than fifty dollars if you bought less than a thirty-day supply. But if you bought a thirty-day supply, you would have to pay fifty dollars for the drug."

Reader, it was like looking under a rock.

"But the actual retail cost of Coumadin, without any drug coverage, is only $38.09."

"Is that what it is? I don't have specific costs."

"So…if I understand you correctly, if I pay for your coverage each month, and use your drug card, it would cost me fifty dollars to buy Coumadin. But if I don't use your drug card, I'd only have to pay thirty-eight dollars."

"Well, yeah."

"So, if I had your drug card, which I'm paying thirty dollars a month for, I'd be better off not using it. Because if I don't use it, I'd save twelve dollars."

Bright, cheerful, trying-to-be-helpful voice, "That's true."

There are all sorts of comments a consumer could make at that point, but I simply thanked her for her time, hung up. Drew several deep, dark lines through her company's name.

My whole day was like that, unfortunately. Despite all the yak about how wonderful the Internet is, the "Information Highway", after spending hours in front of the monitor I couldn't find a single worthwhile drug plan for Mary.

So we're gradually adjusting to me being out of work, taking the steps we need to during this transitional period.

On Friday, July 15, my last day of work, it did occur to me that after that day I'd no longer have a job.

Mary showed me something she had found on the Internet.

It was a calendar that listed all the official designations assigned to different days (like, such and such a day is Mother's Day, or Latino Culture Day).

July 15 was Cow Appreciation Day.

I've always liked cows, so somehow it helped knowing I lost my job on Cow Appreciation Day.

We decided to have beef for dinner.